Getting job offers is the goal of every software engineer I work with. Growing your skills and knowing how to interview are so important in getting in the door and then getting an offer. But your software engineer salary is much more complicated than just how big is your paycheck going to be and what kind of bonuses and incentives does the company have.

One big thing to consider is cost of living because chances are good that you will be getting offers in more than one city, more than one state.

This is something really important to consider because simply put a $150,000 salary in San Francisco is vastly different from a $150,000 salary in really any other city in the country. Using San Francisco and Denver as two good examples of this, the cost of living will be dramatically different because of a handful of factors. Their housing costs will be different. Food costs will be different.

In reality most things are going to cost much less in Denver than they would in San Francisco. All of these factors can make calculating your software engineer salary difficult and I highly recommend using a cost of living calculator to help you make your decision.

Looking deeper into our example I used a COL calculator on NerdWallet to compare a salary in SF and Denver. To use the calculator you simply put in your city that you want to consider the salary for, and then the relative salary in the city you are considering moving to. In this example you can see that a $150,000 salary in San Francisco would be the same as a $93,000 salary in Denver.

This salary would allow us to live exactly the same lifestyle. The calculator will also give you average pricing for housing, food, etc. for each city. This is a great starting point to determining what job to take when considering your software engineer salary offers.

Cost of living calculators do not show the whole picture

There is one very big problem with these calculators however. These calculations (while helpful) are not showing you the whole picture. The reason they don’t is because they are assuming you are spending 100% of your income on living expenses.

Spending all of your money each month of housing, food, entertainment, etc. If that’s the case than yes, you can have the same lifestyle in both cities with different salaries. However, the problem comes when you think about actually saving for retirement.

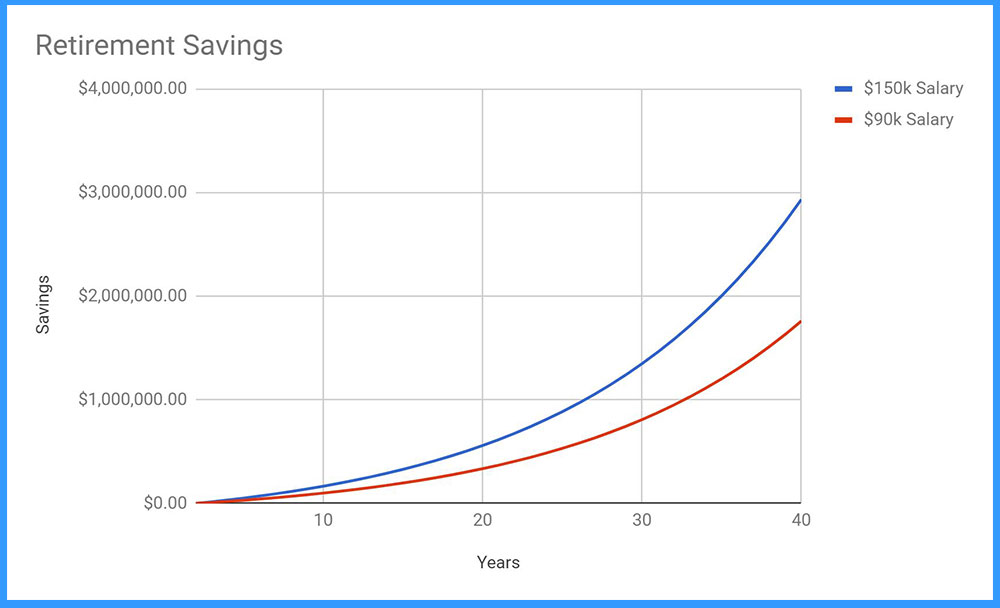

Software Engineer Salary – Retirement Savings

If we save 10% of our income off of a $150,000 salary vs a $90,000 salary, we are ending up with dramatically different amounts of money at retirement. In this case it’s over $1 million difference! Taking into consideration an average 7% interest and other variable factors. When we are considering cost of living between two cities and two companies, it’s important to not just consider that one number and how they compare, but to think through retirement and savings and how they compare. If you want to have the same amount of money at retirement you would have to save 15-18% of your income in Denver vs. only 10% in San Francisco.

What are your goals?

Another thing to think about are your goals. Are you planning to stay in the same place even once you retire or do you think you’ll move? What would the cost of living be like in the new area compared to where you are now? Besides just normal living expenses in retirement you may want to travel, buy a boat, do the fun things you didn’t have time for when you were working. Those all have fixed costs regardless of what city you live in, so it’s something you will really want to consider.

Take the time to crunch the numbers and really consider your goals before accepting an offer. Click To TweetYou need to be sure you are compensating for all of this when you consider your software engineer salary and the cost of living calculations. I would recommend subtracting the savings first (a fixed amount) to consider your retirement. As an example let’s assume we want to save $30,000 a year, which is 20% of our income. If we’re living in San Francisco that means of our $150,000 salary, we’re going to be saving $30,000 and $120,000 remaining.

Taking that $120,000 number to have the same lifestyle in Denver we would have to be making $75,000. But when you take into account wanting to save $30,000 a year for retirement, that $75,000 now needs to be $105,000 in order to be equivalent. This technical change is super important in determining which job opportunity you want to go with. I highly recommend you take the time to crunch the numbers and really consider your goals before accepting an offer.